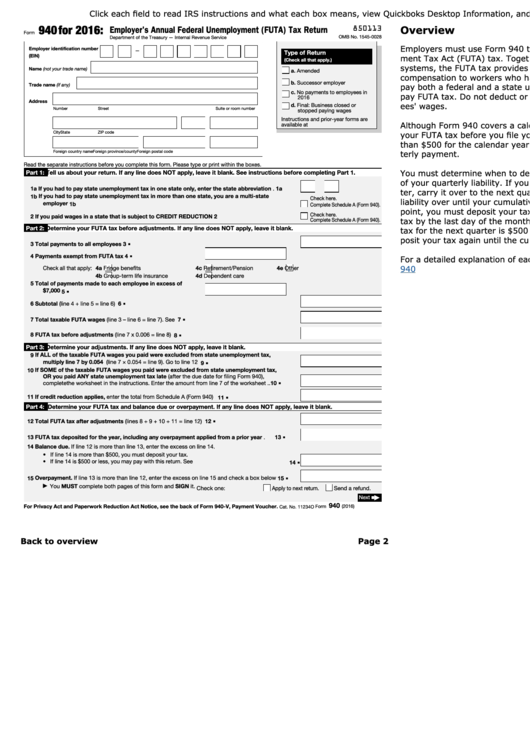

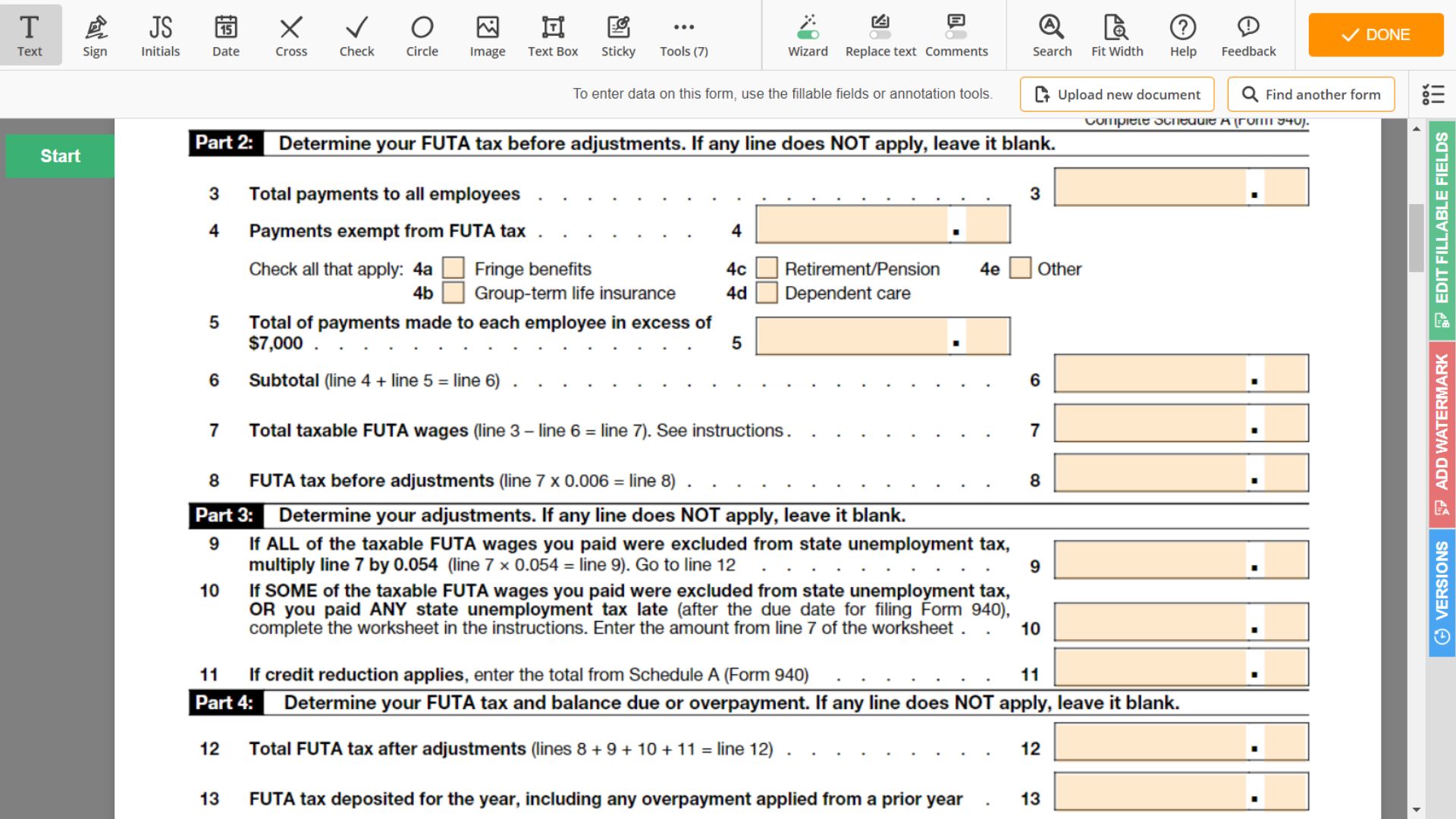

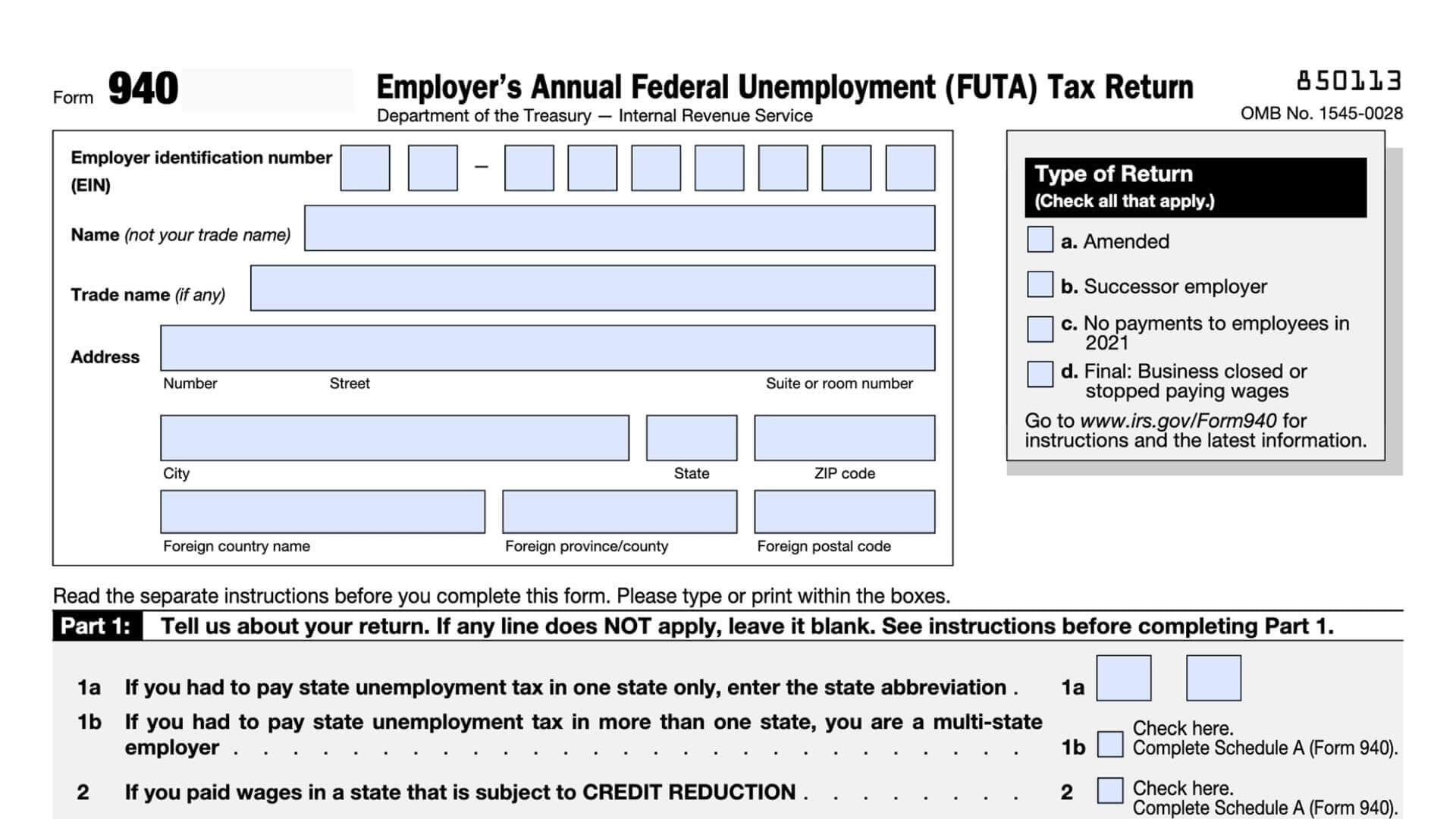

Irs 2025 940 Form. Form 940 is an annual tax form filed by employers to report their federal unemployment tax act (futa) payments and calculations to the internal revenue service (irs). Form 940 is an us federal tax return that every organization should file with the irs to avoid unwanted penalties.

Form 940 is an annual tax form used by u.s. This return or form must conform to the physical layout of the corresponding irs form, although the typeface may differ.

Irs Form 940 2025 Printable, This return or form must conform to the physical layout of the corresponding irs form, although the typeface may differ.

2025 Irs Form 940 Genni Josepha, Form 940 is the federal unemployment tax annual report that employers must file to inform the irs about unemployment tax for their employees.

Irs 940 Form 2025 Judye Bellina, The form is required if you paid wages of $1,500 or more to employees.

2025 Irs Form 940 Genni Josepha, This unemployment tax is not deducted from the salary or payment for the.

2025 Form 940 Alfy Louisa, Form 940 is used to report federal unemployment taxes, while form 941 is used to report medicare, social security, and federal income tax withholding.

940 Form 2025 Where To Mail Mead Stesha, Form 940 is used to report federal unemployment taxes, while form 941 is used to report medicare, social security, and federal income tax withholding.